how does maine tax retirement income

Your tax bracket depends on your taxable income and your filing status. Retirement plans accounts.

Examples are records from the hospital police insurance etc or disability or retirement documentation.

. Who purchase and use HR Block desktop software solutions to prepare and successfully file their 2021 individual income tax return federal or state. Line the amount of railroad retirement benefits received. Rhode Island provides various tax breaks for Social Security as well as provisions for pension income military retirement pay and retirement funds including 401k and 403b accounts.

Tier 1 Benefits Including and Equivalent Railroad Retirement Benefits. Utahs legislation provides for a retirement credit of up to 450 for taxpayers who were born on or before December 31 1952. 20000 for those ages 55 to 64.

Neither H. Up to 3500 is exempt Colorado. Income tax return complete Maine Form 1040ME according to the instructions below.

Bidens FY 2023 Budget Would Result in 4 Trillion of Gross Revenue Increases. The state income tax in Maine is based on just three brackets. The highest top tax rates on individual and corporate income in the developed world.

2021 HRB Tax Group Inc. Fill in your name address social security number telephone number. Up to 2000 of retirement income.

HR Block Maine License Number. Earners with incomes landing in the bottom bracket pay a rate of 580. To find a financial advisor who serves your area try our free online matching tool.

Download a sample explanation Form 1099-R and the information reported on it. Overview of Maine Retirement Tax Friendliness. Military retirement pay is partially taxed in.

The individual income tax rate in Puerto Rico is progressive and ranges from 0 to 33 depending on your income. It also has above average property taxes. Inventory taxes fall under the umbrella of the property tax which is the largest tax paid by businesses at the state and local levels.

This income tax calculator can help estimate your average income tax rate and your salary after tax. Benefit Payment and Tax Information In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a refund of contributions in the prior calendar year. How many income tax brackets are there in Puerto Rico.

In addition to taxes on the value of buildings and land businesses can also pay property. 10 12 22 24 32 35 and 37. As we continue to look at tax types that can harm states post-coronavirus recovery its worth highlighting taxes on business inventory.

President Bidens budget proposes several new tax increases on high-income individuals and businesses which combined with the Build Back Better plan would give the US. While Maine does not tax Social Security income other forms of retirement income are taxed at rates as high as 715. Meanwhile top earners face a rate of 715.

Maine state taxes 2022. And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. The income tax system in Puerto Rico has 5 different tax brackets.

Retirement Income and Annuity Tax Claiming Social Security Survivor Benefits Social Security. Download or print the 2021 Maine Income Tax Instructions Form 1040ME Instructions for FREE from the Maine Revenue Services. This amount can generally be found on federal Form RRB-1099 or RRB-1099-R.

Up to 24000 of military retirement pay is exempt for retirees age 65 and older. However standard text messaging. Maine State Income Taxes for Tax Year 2021 January 1 - Dec.

There are seven tax brackets for most ordinary income for the 2021 tax year. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a ME state returnThe Maine tax filing and tax payment deadline is April 18 2022Find IRS or Federal Tax Return deadline details. Take-Home Pay These are the taxes owed for the 2021 - 2022 filing season.

Arizona uses a graduated-rate income tax meaning the rate you pay depends on how much money you make. It does not provide for reimbursement of any taxes penalties or interest imposed.

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly

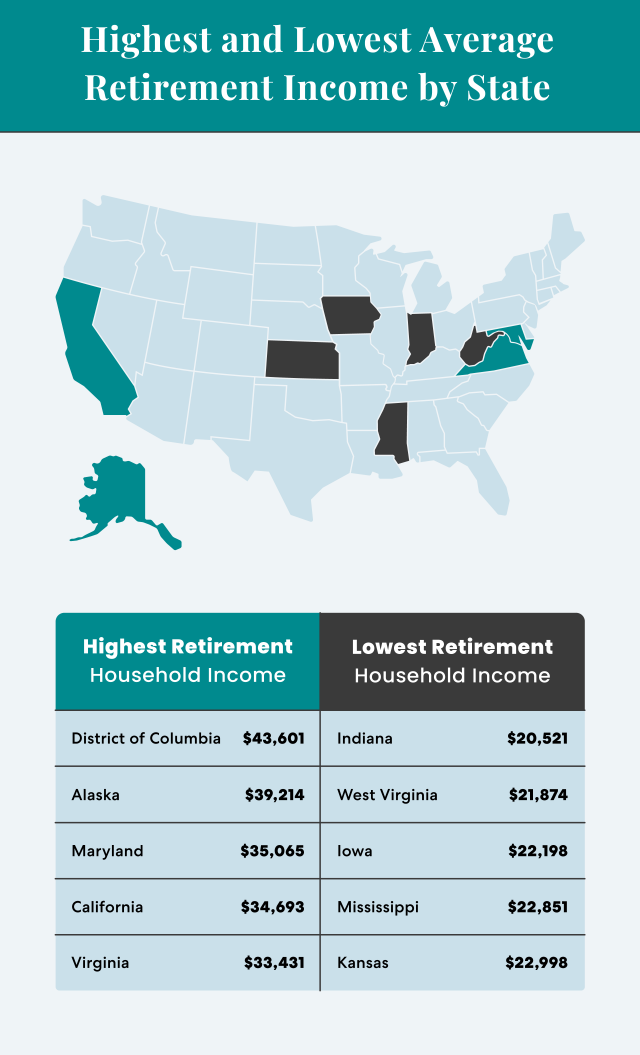

Average Retirement Income Where Do You Stand

12 Reasons To Retire In Maine Down East Magazine

Maine Retirement Taxes And Economic Factors To Consider

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Benefit Payment And Tax Information Mainepers

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Pros And Cons Of Retiring In Maine Cumberland Crossing

The Harsh Reality For People With Disabilities Work And Struggle To Afford Medicine Or Stay Home And Struggle To Live Is Disability How To Apply Incentive

Recent Changes To The Maine Income Tax Conformity Bill Wipfli

Military Retirees Retirement Retired Military Military Retirement

Maine Retirement System Pension Info Taxes Financial Health

Maine Retirement Guide Maine Best Places To Retire Top Retirements

Maine Retirement Tax Friendliness Smartasset

Maine Income Tax Calculator Smartasset